Important question Corporate Accounting b com Sol DU Last year Paper Pdf || Sol study material B com Sol Du || question with answers pdf

Corporate Accounting Important question with answers with pdf

Theory

Question: write any three differences between Accounting Standard-3 and Ind AS-7 ?

Accounting Standard-3 (AS-3) and Ind AS-7 are both financial reporting standards that provide guidance on the presentation of cash flow statements. However, there are a few key differences between the two. Here are three of them:

1. Scope and Applicability:

- AS-3: Accounting Standard-3, issued by the Institute of Chartered Accountants of India (ICAI), applies to all enterprises except those classified as small and medium-sized enterprises (SMEs). It focuses on the presentation of cash flows from operating, investing, and financing activities.

- Ind AS-7: Ind AS-7, issued by the Accounting Standards Board (ASB) under the authority of the Ministry of Corporate Affairs (MCA) in India, applies to all entities that adopt the Indian Accounting Standards (Ind AS). It provides guidance on the presentation of statements of cash flows, similar to AS-3.

2. Reporting Period:

- AS-3: Under AS-3, a cash flow statement is required to be prepared annually, and it covers a period of 12 months.

- Ind AS-7: Ind AS-7 allows for the preparation of cash flow statements on a quarterly basis if deemed necessary. It provides flexibility to entities to report cash flows more frequently.

3. Classification of Interest and Dividends:

- AS-3: AS-3 permits the classification of interest and dividends received and paid as either operating or investing cash flows. The choice of classification is left to the reporting entity based on its nature of operations.

- Ind AS-7: Ind AS-7 requires the classification of interest paid as an operating cash flow, while interest and dividends received are classified as operating or investing cash flows, depending on the nature of the entity's operations. Dividends received from associates or joint ventures are specifically classified as operating cash flows.

It's important to note that the specifics of these standards may vary depending on the jurisdiction and any subsequent amendments or updates made to them. Always refer to the latest version of the standards and consult with relevant accounting authorities for the most accurate and up-to-date information.

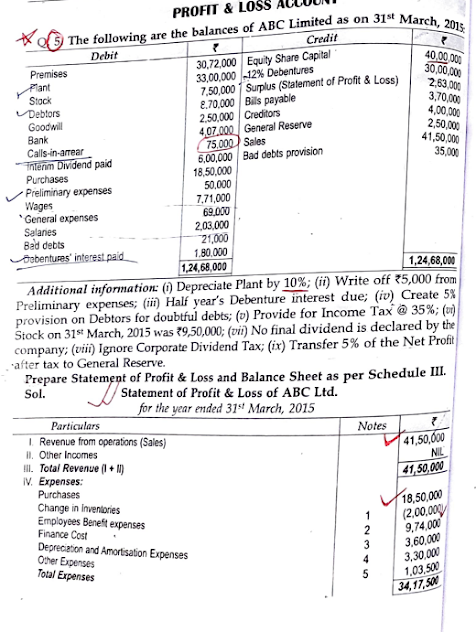

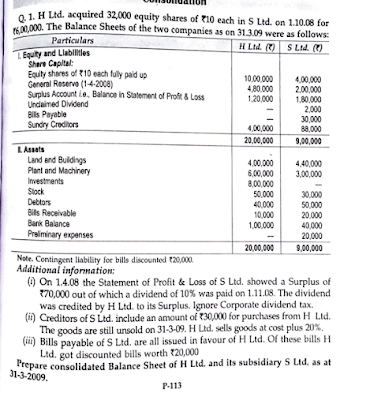

Numerical